Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Stronger Investment Climate For Sustainable Growth: Country, Sector, and Thematic

Investing has always been a crucial element in driving economic growth and development. In recent years, the focus has shifted towards sustainable investment strategies that not only generate financial returns but also have a positive impact on the environment and society. As a result, the need for a stronger investment climate that supports sustainable growth in different countries, sectors, and themes has become increasingly important. This article explores the key factors contributing to a robust investment climate and highlights the potential for sustainable growth.

The Role of Government Policies and Regulations

Strong government policies and regulations are essential for creating a favorable investment climate. They provide stability, predictability, and transparency, which are essential for attracting both domestic and foreign investments. Governments need to establish clear rules and regulations, protect property rights, and promote a fair and competitive business environment. By doing so, they can instill confidence in investors, spur innovation, and drive sustainable growth in various sectors and themes.

Country-Specific Investment Opportunities

Different countries offer unique investment opportunities based on their specific strengths and resources. For example, emerging markets such as China and India provide tremendous potential for growth, given their large and rapidly expanding consumer markets. On the other hand, developed countries like the United States and Germany offer attractive investment prospects in sectors such as renewable energy and technology. By understanding the country-specific factors influencing investment opportunities, investors can make informed decisions and contribute to sustainable growth.

5 out of 5

| Language | : | English |

| File size | : | 7515 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 215 pages |

| Screen Reader | : | Supported |

| Mass Market Paperback | : | 288 pages |

| Lexile measure | : | NP1340L |

| Item Weight | : | 2.72 ounces |

| Dimensions | : | 5.83 x 0.12 x 8.27 inches |

| Paperback | : | 53 pages |

Sectoral Investment Strategies

Another critical aspect of a stronger investment climate is the identification of promising sectors with high growth potential. Renewable energy, healthcare, technology, and infrastructure are just a few examples of sectors that are likely to experience significant growth in the coming years. Investing in these sectors not only offers financial returns but also contributes to sustainable development. By allocating capital to sectors that are aligned with long-term societal and environmental trends, investors play a pivotal role in shaping a more sustainable future.

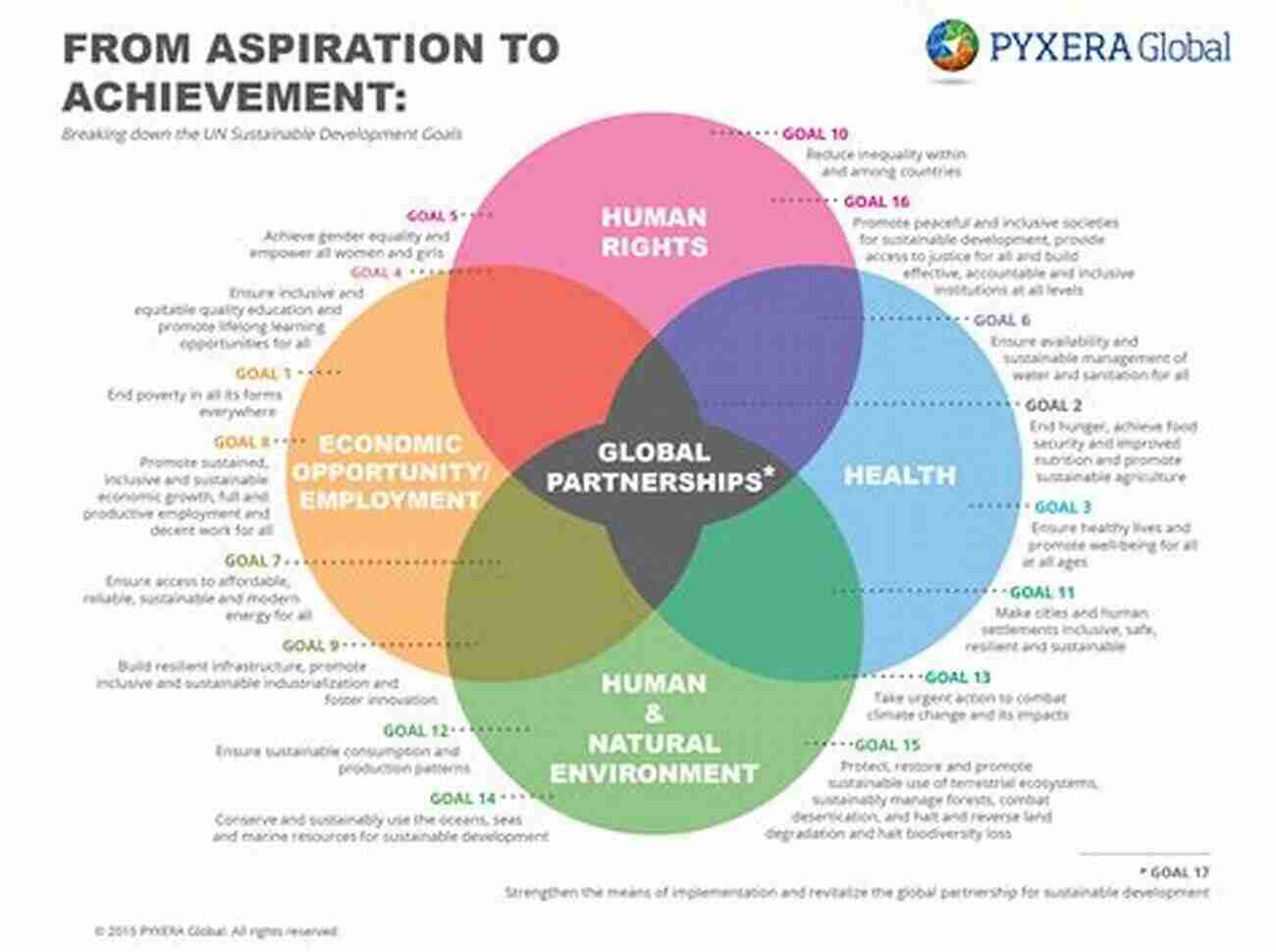

Thematic Investments: Addressing Global Challenges

Thematic investments focus on addressing global challenges such as climate change, poverty, and inequality. By investing in companies or funds that tackle these issues directly, investors can not only generate financial returns but also drive positive change. Impact investing, for instance, aims to generate both financial and social or environmental returns. By identifying and supporting thematic investments, investors can contribute significantly to sustainable growth, ensuring a better future for generations to come.

The Importance of ESG Factors

Environmental, Social, and Governance (ESG) factors have gained prominence in recent years as investors realize the importance of considering sustainability in their decision-making process. ESG integration allows investors to evaluate the long-term risks and opportunities associated with an investment. By incorporating ESG factors, investors can identify companies with strong sustainability practices and contribute to a stronger investment climate for sustainable growth.

Achieving sustainable growth requires a stronger investment climate that considers environmental, social, and governance factors. By implementing favorable government policies and regulations, identifying country-specific investment opportunities, focusing on promising sectors, and supporting thematic investments, investors can drive positive change while generating financial returns. The integration of ESG factors further enhances the investment climate, ensuring a sustainable future for all. By embracing sustainable investment strategies, investors can contribute to a world where economic growth goes hand in hand with environmental and social progress.

5 out of 5

| Language | : | English |

| File size | : | 7515 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 215 pages |

| Screen Reader | : | Supported |

| Mass Market Paperback | : | 288 pages |

| Lexile measure | : | NP1340L |

| Item Weight | : | 2.72 ounces |

| Dimensions | : | 5.83 x 0.12 x 8.27 inches |

| Paperback | : | 53 pages |

The Cook Islands is among the best performing Pacific island economies, with many structures in place that support private sector investment, including an internationally competitive tax regime, an open trade regime, and good standards of education and health care. Future prospects are positive due to the growing tourism sector, and potential resource revenues from seabed minerals prospecting activities are another favorable development. The Government of the Cook Islands is committed to pursuing sustainable development through private-sector-led growth. Yet, the Cook Islands faces significant challenges in realizing its full potential, including a sluggish business entry process that discourages foreign investment, inadequate infrastructure that threatens to degrade the natural environment, complex land ownership and inadequate land use planning processes, and a weak collateral framework.

Calvin Fisher

Calvin FisherThe Most Insightful and Liberating Experiences Found in...

When it comes to expanding our...

D'Angelo Carter

D'Angelo CarterDax To The Max Imagination: Unlock the Power of...

Welcome to the world of Dax To...

Chris Coleman

Chris ColemanThe Hidden Case of Ewan Forbes: Uncovering the Mystery...

Ewan Forbes: a...

Morris Carter

Morris CarterWhen Newport Beat New Zealand: A Historic Rugby Upset

The rivalry between Newport and New Zealand...

David Mitchell

David MitchellThe Soul of an Astronomer: Women of Spirit

Astronomy, the study of...

Ethan Gray

Ethan GrayThe Military Origins Of The Republic 1763-1789

When we think about the birth of the...

Guy Powell

Guy PowellRPO System for 10 and 11 Personnel: Durell Fain

When it comes to...

Evan Hayes

Evan HayesMadness: The Ten Most Memorable NCAA Basketball Finals

College basketball fans eagerly await the...

Jorge Amado

Jorge AmadoDiscover the Magic of Polish: English First 100 Words,...

Are you ready to embark on a linguistic...

Shaun Nelson

Shaun NelsonUnlock the Secrets of Edwidge Danticat's Breath, Eyes,...

Are you delving into the world...

Walt Whitman

Walt Whitman300 Years Liechtenstein: The Birth of Fish Out of Water...

Once upon a time, in the...

Jaden Cox

Jaden CoxExploring the Legendary Surfers of Early Surfing in the...

Surfing, a sport...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Brett SimmonsUnveiling the Power of Geometrical Multiresolution Adaptive Transforms in...

Brett SimmonsUnveiling the Power of Geometrical Multiresolution Adaptive Transforms in...

Mikhail BulgakovThe Electromagneto Mechanics of Material Systems and Structures: Unlocking...

Mikhail BulgakovThe Electromagneto Mechanics of Material Systems and Structures: Unlocking...

Manuel ButlerUnlock the Hidden Potential Within: Journey towards Chakra Energy Balancing...

Manuel ButlerUnlock the Hidden Potential Within: Journey towards Chakra Energy Balancing... Chuck MitchellFollow ·16.1k

Chuck MitchellFollow ·16.1k Harry CookFollow ·16.5k

Harry CookFollow ·16.5k Darius CoxFollow ·8.8k

Darius CoxFollow ·8.8k Fletcher MitchellFollow ·5k

Fletcher MitchellFollow ·5k Jarrett BlairFollow ·3.1k

Jarrett BlairFollow ·3.1k Kazuo IshiguroFollow ·17.3k

Kazuo IshiguroFollow ·17.3k Nathan ReedFollow ·13.1k

Nathan ReedFollow ·13.1k Javier BellFollow ·3.6k

Javier BellFollow ·3.6k