Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Comparative Framework Of Tax Incentives For Start Up Investors Springerbriefs: A Comprehensive Guide

Investing in start-ups can be both exciting and risky. While the potential for high returns is enticing, the inherent volatility of young companies can give even the most experienced investors pause. This is where tax incentives come into play, providing an added boost to encourage investment in start-ups. In this comprehensive guide, we will delve into the comparative framework of tax incentives for start-up investors, specifically focusing on the insights presented in the SpringerBriefs publication.

An Overview of Tax Incentives

Tax incentives are government measures designed to stimulate economic growth by offering various benefits to investors. When it comes to start-ups, these incentives can take different forms, ranging from tax credits and deductions to exemptions and deferrals. The aim is to provide investors with financial advantages that mitigate the risks associated with funding early-stage ventures.

However, each country implements its own tax incentive programs, resulting in a complex landscape that demands careful analysis. The SpringerBriefs publication Comparative Framework Of Tax Incentives For Start Up Investors offers a comprehensive examination of tax incentives in various jurisdictions, providing invaluable insights for investors.

4.5 out of 5

| Language | : | English |

| File size | : | 2434 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 211 pages |

| Screen Reader | : | Supported |

| X-Ray for textbooks | : | Enabled |

Comparative Framework: Insights from the SpringerBriefs Publication

The SpringerBriefs publication titled "Comparative Framework Of Tax Incentives For Start Up Investors" explores the tax incentive programs in different countries. It offers a detailed comparative analysis of how these programs are structured and their effectiveness in encouraging start-up investments.

The authors highlight the importance of understanding the regulatory framework and tax policies of each country before making investment decisions. They present key factors that contribute to successful tax incentive programs, such as clarity, simplicity, stability, and transparency.

: "tax-incentives-for-start-up-investors-comparative-framework-springerbriefs"

Covering a broad range of jurisdictions, the publication examines tax incentive programs in countries like the United States, Germany, Singapore, and Australia. By analyzing these programs, investors can gain insight into the best practices and potential pitfalls associated with each country's approach to incentivizing start-up investments.

The publication provides a comparative framework that allows investors to assess the tax benefits offered in different countries. It explores the eligibility criteria, tax exemptions, and deductions available to start-up investors, equipping readers with the knowledge needed to make informed decisions.

In addition to tax incentives, the publication also explores other factors that influence start-up investments. These include the legal and regulatory environment, access to funding, and the presence of an entrepreneurial ecosystem. By considering these factors alongside tax incentives, investors can develop a comprehensive understanding of the investment landscape in each country.

The Benefits of Utilizing a Comparative Framework

Investing in start-ups can be highly rewarding, but it requires thorough research and analysis. By utilizing the insights presented in the SpringerBriefs publication, investors can better navigate the complexities of tax incentives and make informed decisions.

The comparative framework offered in the publication allows investors to benchmark different countries and identify the most attractive tax incentive programs. It serves as a guide to understanding the intricacies of each program, evaluating their effectiveness, and assessing the potential return on investment.

Furthermore, the publication offers valuable insights for policymakers and government officials. By understanding the comparative framework of tax incentives, policymakers can identify areas for improvement and design more efficient programs to attract start-up investments.

The world of start-up investing is constantly evolving, and tax incentives play a crucial role in supporting and stimulating this dynamic sector. Understanding the comparative framework of tax incentives for start-up investors is essential for making sound investment decisions.

The SpringerBriefs publication "Comparative Framework Of Tax Incentives For Start Up Investors" provides an intricate analysis of tax incentive programs in various countries. By offering insights and comparisons, it equips investors with the knowledge needed to navigate the complex world of start-up investments.

With this comprehensive guide, investors can utilize the comparative framework to identify the most attractive tax incentive programs, minimize risks, and maximize their returns in the exciting realm of start-up investments.

4.5 out of 5

| Language | : | English |

| File size | : | 2434 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 211 pages |

| Screen Reader | : | Supported |

| X-Ray for textbooks | : | Enabled |

This book examines tax incentives for investors in start-up companies through a critical analysis of Australia’s early-stage investors (ESI) program, and a comparison of that program with the United Kingdom’s Seed Enterprise Investment Scheme (SEIS) upon which it is loosely modelled. It discusses the importance of innovation and the special role that venture capital plays in supporting start-ups, and explains the policy rationale for introducing the ESI program as well as dissecting its technical requirements in detail. Special attention is devoted to the program’s ‘early stage’ and ‘innovation’ requirements, which are crucial for determining whether a start-up qualifies for the tax incentives.

The book is the first in-depth scholarly legal analysis of the ESI program and the first occasion it has been compared and contrasted with a foreign program. The comparative discussion of the ESI program with the SEIS program enables the authors to make suggestions for reforms to the ESI program so that it can better achieve its policy objectives. The fact that the book includes reform suggestions makes it particularly interesting for policy makers. It is also of broad relevance to legal and finance scholars and students as well as entrepreneurs, angels, venture capitalists and their advisors.

Calvin Fisher

Calvin FisherThe Most Insightful and Liberating Experiences Found in...

When it comes to expanding our...

D'Angelo Carter

D'Angelo CarterDax To The Max Imagination: Unlock the Power of...

Welcome to the world of Dax To...

Chris Coleman

Chris ColemanThe Hidden Case of Ewan Forbes: Uncovering the Mystery...

Ewan Forbes: a...

Morris Carter

Morris CarterWhen Newport Beat New Zealand: A Historic Rugby Upset

The rivalry between Newport and New Zealand...

David Mitchell

David MitchellThe Soul of an Astronomer: Women of Spirit

Astronomy, the study of...

Ethan Gray

Ethan GrayThe Military Origins Of The Republic 1763-1789

When we think about the birth of the...

Guy Powell

Guy PowellRPO System for 10 and 11 Personnel: Durell Fain

When it comes to...

Evan Hayes

Evan HayesMadness: The Ten Most Memorable NCAA Basketball Finals

College basketball fans eagerly await the...

Jorge Amado

Jorge AmadoDiscover the Magic of Polish: English First 100 Words,...

Are you ready to embark on a linguistic...

Shaun Nelson

Shaun NelsonUnlock the Secrets of Edwidge Danticat's Breath, Eyes,...

Are you delving into the world...

Walt Whitman

Walt Whitman300 Years Liechtenstein: The Birth of Fish Out of Water...

Once upon a time, in the...

Jaden Cox

Jaden CoxExploring the Legendary Surfers of Early Surfing in the...

Surfing, a sport...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Richard AdamsThe Perfect Way of Guiding Your Teenage Years - Tips, Strategies, and Advice

Richard AdamsThe Perfect Way of Guiding Your Teenage Years - Tips, Strategies, and Advice

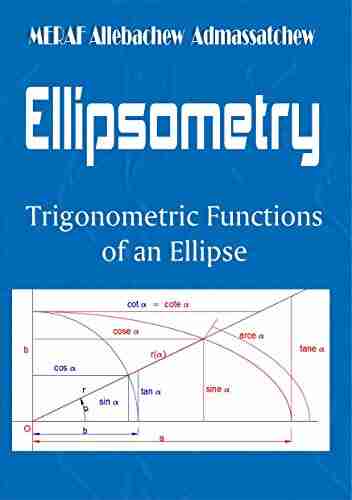

Arthur MasonUnlocking the Secrets of Trigonometric Functions: An Ellipse Cheat Sheet for...

Arthur MasonUnlocking the Secrets of Trigonometric Functions: An Ellipse Cheat Sheet for...

Jonathan FranzenOne Simple Secret On How To Beat Bad Days And Live A Happy Joy-Filled Life

Jonathan FranzenOne Simple Secret On How To Beat Bad Days And Live A Happy Joy-Filled Life George MartinFollow ·4.6k

George MartinFollow ·4.6k August HayesFollow ·11.7k

August HayesFollow ·11.7k Dominic SimmonsFollow ·18.4k

Dominic SimmonsFollow ·18.4k Jared PowellFollow ·13.8k

Jared PowellFollow ·13.8k John SteinbeckFollow ·15.6k

John SteinbeckFollow ·15.6k John MiltonFollow ·14.5k

John MiltonFollow ·14.5k José SaramagoFollow ·11.3k

José SaramagoFollow ·11.3k Dashawn HayesFollow ·7.3k

Dashawn HayesFollow ·7.3k